?????? ?? ????? ?? ??????????? ?? ??????????? ??? ?????

The power of compounding is often underestimated when it comes to investment as well as loans. While in investments the compounding happens at the end of the tenure, it is other way around when it comes to loans.

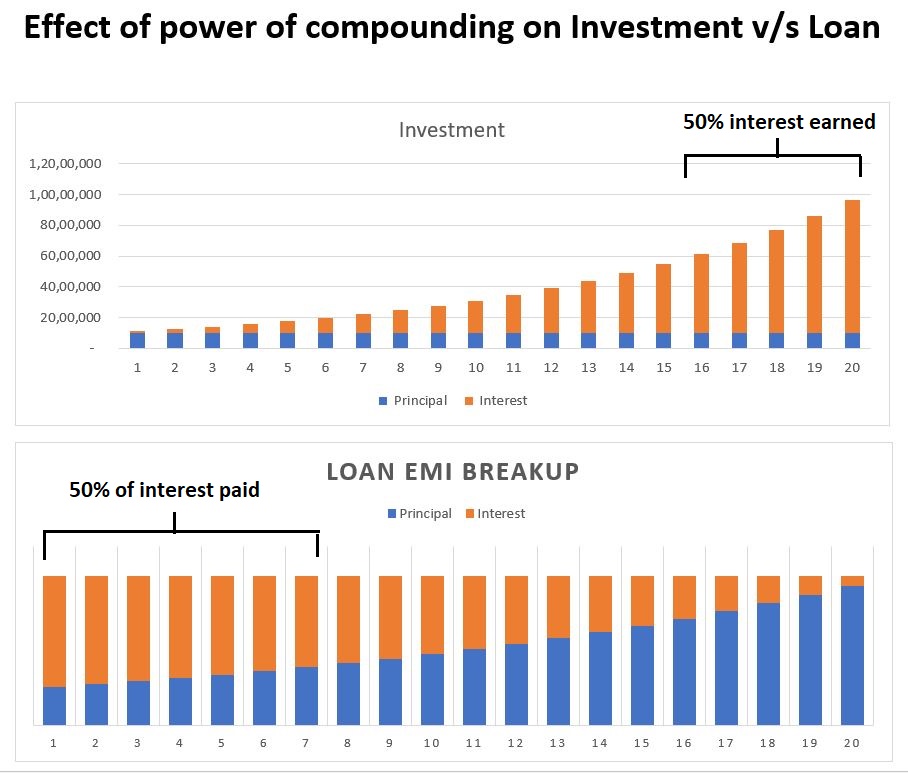

The below is the illustration where the ROI for investment is assumed at 12% p.a and for loan at 7% p.a for a 20 year period.

In case of investments, ??% ?? ????? ????? ?????? ?? ?????? ?? ??? ????? ?? ????? ??? ??????? ??% ?? ?????? ?? ????????? ? ????? where the overall investment has grown 9.6x in 20 yrs. Hence it is wise to keep investments for long term and let compounding do its magic.

In case of loan, you end up paying ??% ?? ????? ???????? ???’?? ???????? ?? ??? ?? ??? ??????? ? ????? ??? ??? ???? ? ????? ???? ??????????? ?? ??????? ?% ????????. Hence it is wise to pay off your loans regularly when they are in early stage to skip the entire high interest paying phase and move it to a level where EMI bifurcation between interest and principal is more towards being equal.