Sensex at 50k, just a pitstop of the ongoing rally or the market has been saturated now?

Recently Sensex during the intraday touched an all time high of 50,184 which is almost double from Mar’20 levels during the lockdown, which brings us to a question that are markets expensive now? Is there a bubble waiting for a trigger to get burst? Is there any fundamental backing to support this valuation?

Let’s find out what the data says, it is imperative to say that the past is always not the reflection of the future but a good data set gives us an idea which is the best cues one can have to predict the next move.

Firstly, the most talked ratio i.e P/E ratio which compares the valuation of the company with its profit/Earnings. A high P/E ratio indicates market being expensive and vice versa

The P/E ratio suggest that the market has discounted the next 1 year earnings growth to be seen going forward in its valuation. If the quarterly result does not support its assumption of earning growth, correction can be expected.

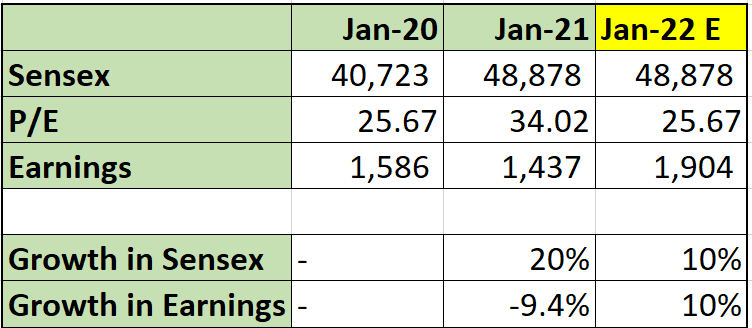

The data above shows that Pre-Covid times during Jan’20, markets were near to its at all time high and was trading at ~25 PE which is almost 10% above its last 3yr average. Currently the P/E is at all time high of 34 but that is due to subdued earning seen during the most unprecedented time of lockdown. If we assume a 10% CAGR growth in Earnings which is almost 2% higher than last 5 yrs EPS growth from the base month of Jan’20, the market at current level justifies the valuation.

The next most discussed ratio is Market cap to GDP ratio or also known as Buffet Indicator named after renowned investor Warren Buffet. Historically Indian market’s average market cap to GDP ratio is around 75%, it was almost 50% in Mar-April’20 crash and its 87% now. Another Ratio which is indicating the market being in overbought territory. This ratio is more dependable since unlike earnings which can be affected due to many accounting reasons this ratio is relatively much stable and generally get affected only due to market volatility

Final Conclusion

At this valuation, one should avoid any lumpsum investments and continue its SIP for long term averaging, any lumpsum can be invested in debt funds and shifted to equity via STP for a year and bulk switches if and when market sees a deep correction.

There are certain sectors like IT, Entertainment and Consumption where either the earnings are expected to increase or remain immune from the economic slowdown. For an aggresive investors increasing concentration towards these sectors by regularly buying stocks of industry leaders can prove to be a wise decision for this calendar year.