How SIPs has faired out in the last 12 years?

Since 2020, market has been more volatile than ever due to covid’19 pandemic outbreak coupled with other factors like war, liquidity, interest rates etc. Many investors have mixed response on their investments depending upon the market levels they started and hence cannot gauge a rational expectation to be built around their investments.

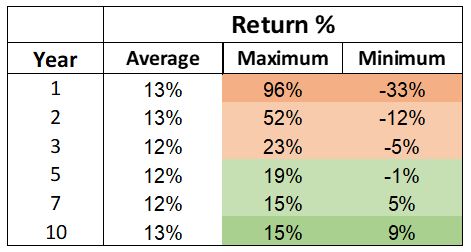

Hence we pulled out some historical data to build a rational expectations from their investments to measure the performance and project the returns for their wellbeing. Below is the data for UTI Nifty Index Fund which is a fund replicating the Nifty 50 Index starting from 1st Jan 2011 where rolling returns (average returns) are considered to avoid any bias related to current levels.

The biggest highlight here is the column ‘Average’ where the returns are almost same around 12-13% but it does not answers anything since average rule does not gauge the volatility. In year 1, the maximum and minimum returns were 96% and -33% which gives us a range of 129% talking volumes about volatility but as and when the time progress, the returns are narrowed towards average and settles in +- 3% from its average in 10-year period. Making us more comfortable with the returns which help us in building the right expectations.

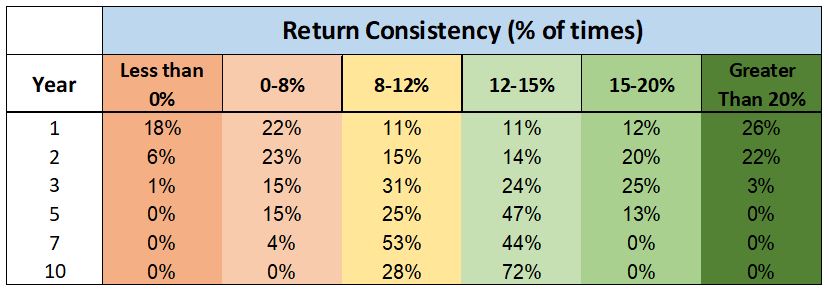

Any major temporary rally / slip can expand the overall range and does not speak about the probability. Hence it still does not give us the right answer we’re looking at. To break in further, we have further segregated the returns into different categories as mentioned below.

It is evident from the above tab that SIP may give negative and low returns in the earlier phase but on the contrary, there is an almost equal probability for higher than average returns. As and when the time progress, the instances of extreme returns on either of the sides slips down and moves towards its long term average of 13%. Hence it is said that SIP in Equity should always be kept for long term as returns in short term are too volatile to gauge.

How do we further optimise the returns?

The answer to this is in 2 simple words ‘Asset Allocation’. Although the most over used term in personal finance, it is ironically also the most under used tool in practice. A valuation based asset allocation model can always help one to get more stable returns on their portfolio. It helps in putting a higher chunk of equity in lower valuation and vice versa thus pushing the buy average down further.

Any lumpsum received via bonus or maturity/sale of assets can be parked especially when the portfolio returns are on the lower side due to correction seen in the market. This will further push your weighted average investment towards the lower side of the valuation thus giving better risk-reward ratio.

Furthermore, biggest risk to an investor’s portfolio is the investor’s behaviour itself. If the exorbitant returns makes one greedy and low returns fearful, it can have detrimental impact on the portfolio if certain decisions are taken in that phase.

If the market fall makes an investor happy realising better prices are available for the same scrip and sharp rally in the market makes one vigilant of higher valuation, then that investor’s behaviour will do good to his/her portfolio.

Historically, it is a known fact that every crisis has been a buying opportunity known in the hindsight. Hence keeping a constructive view on the economy and thus the market can make an investor much more confident about the future outlook. In simple words, when others are fearful, its time to be greedy and when others are greedy its time to be cautious.

Happy Investing!