How the SIP in Equity funds have performed over the last decade?

Below is the illustration of a large cap fund having a track record of more than 13 years, the fund has delivered above average returns in the given phase as compared to peers and index.

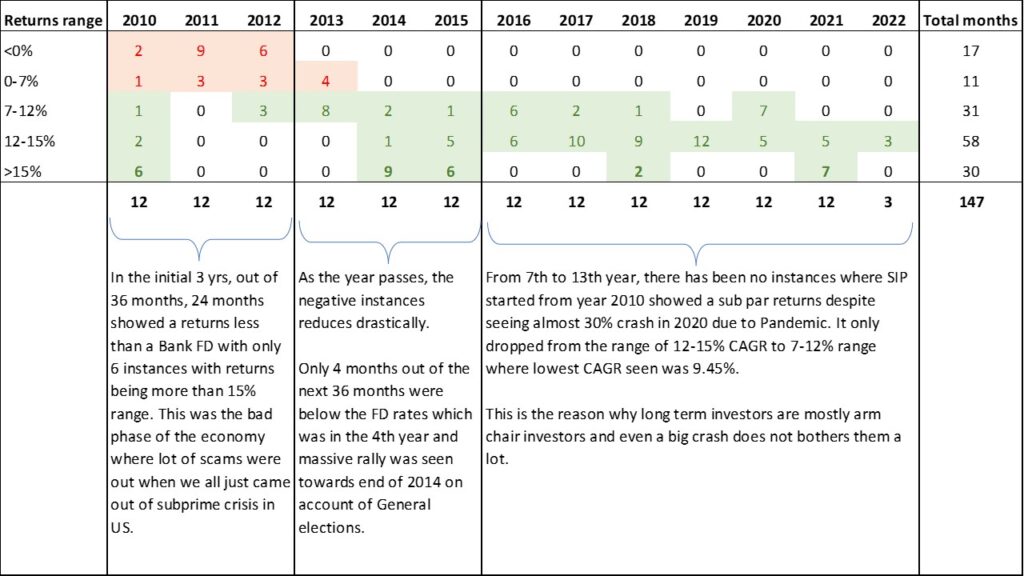

First Phase(Initial 3 years): From the data points it has been observed that the returns were sub par in the initial 3 years having almost 2/3rd instances of negative returns and sub par returns.

Moreover, the data from mutual fund houses also suggests that an average investor stops SIP in ~3.5 years. This doesn’t seem like a coincidence. Most investors lose their patience, stops their investment in funds and start investing elsewhere. Their behaviour is a function of returns of the portfolio and rather than focusing on the process they tend to focus on results and hence lose out on the process of discipline investment.

Hence, the longer you stay invested for, better are the chances of good returns and compouding benefits investors very well in long term.

Second Phase(4th-6th year): In this phase, the number of negative returns instances dropped significantly, the 4th year did had some negative instance due to the event popularly known as ‘Taper Tantrum’ where US Fed increased the interest rate and INR slipped from ~54 to 69 v/s Dollar within 2 months and to curb it government had to increase the import duty of gold from 2.5% to 12.5% overnight.

The 5th and 6th year returns were good due to favorable results of general elections and the rally continued all the way till 2017.

Third Phase(7th-13th year): Since the investor must be investing all the way back from 2010 level the buy average was at deep discount as compared to current level, hence even a fall of ~30% seen in Mar’20 due to pandemic and lockdown did not affected the returns much and it was still above 9% CAGR at it lowest point.

There is a famous saying that history does not repeat itself but it rhymes, hence the above data points are articulated to set up a base expectations regarding the expected returns in different time ranges. There was and will be dark patches temporarily and one has to sail through it for better times ahead. Patience is the key and hence the saying goes one does not need big brains to make money in the market but big stomach to digest the volatility.

One must understand that falling is a part of the game and cannot be avoided completely one can only be prepared for it. One better way to deal with it is following the asset allocation by investing aggressively in the bear market and conservatively in an expensive market and thus keeping the portfolio returns more consistent.

Stay updated with our blogs till then keep the Good EMI going..