Don’t be a minimum guy..

This quote from a recent series on OTT platform has got lot of fame and many memes are being circulated across the social media apps where a boss expects maximum output from his employees.

The analogy that we are trying to present here is for you to be the boss of your own investment portfolio and do not settle for the low return on your portfolio which does not even beat the inflation of 6%.

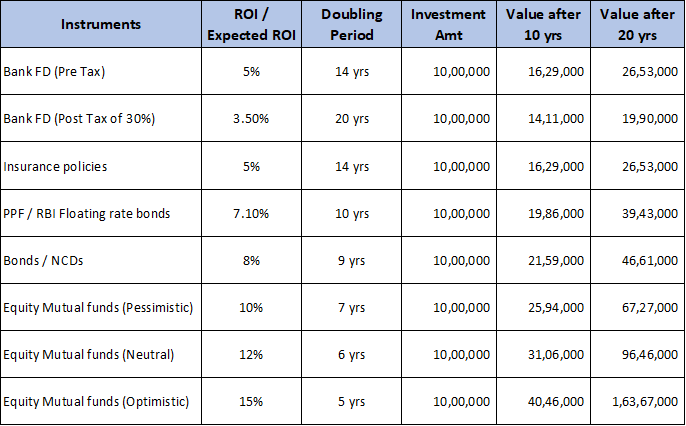

We are not trying to convey here with the below table that one should totally avoid low return product and focus only on high return instruments, it totally depends on your asset allocation which is a function of your financial goals. Every product has its own pros and cons and proper asset allocation helps to maintain the right mix.

ROI is derived from either the currently prevailing interest rate or past performance of the funds.

Disclaimer:

#Past performance is not an indicative of future returns.