Can Sensex reach 2,00,000 by 2031?

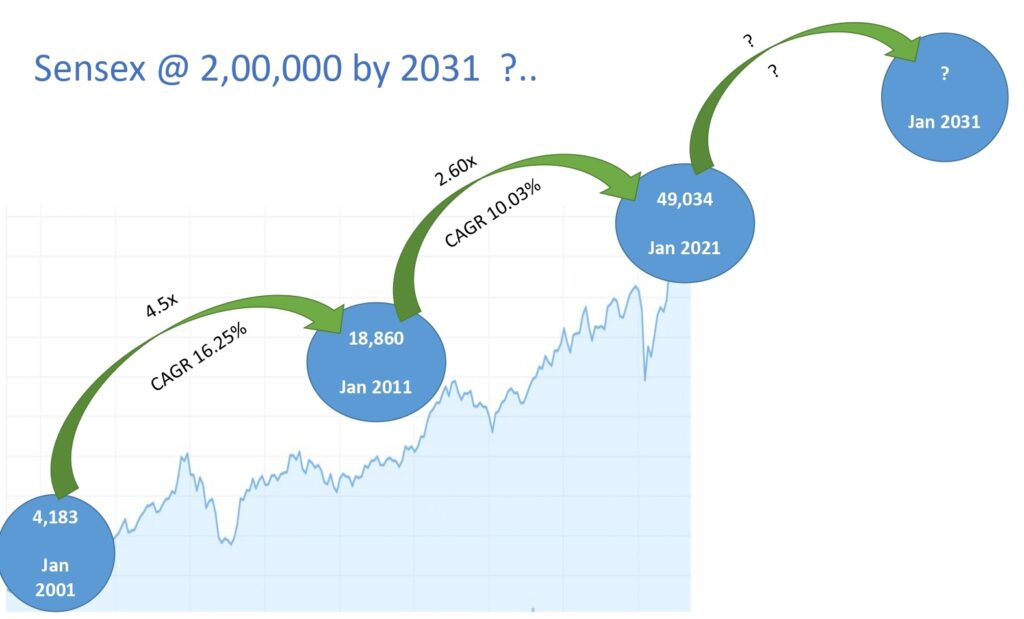

Recently, Mr. Raamdeo Agrawal, chairman of Motilal Oswal group said in an Interview that Sensex can reach 2,00,000 by 2031. While a 4x jump in 10 years seems unrealistic at first sight, it is asking for a CAGR of roughly 15% over the next 10 years.

Figure 1 Data source: bseindia.com and investing.com

2001 – 2011

In the Picture above, we can see that in the 2001-01 era, the market had delivered a return of 16.25% despite the 2008 subprime crisis. The market has grown 4.5x i.e Rs. 10 Lac invested would have been 45 Lacs in these 10 years. From 2002 – 07, a major uptrend was witnessed across the globe and the market was in its best bull run till date. In fact in 2007, Sensex was at ~20,000 so 5x returns were delivered in just 7 years, and post those 3 years was just the crash and rebound.

2011-2021

The next decade was relatively slower not only for India but globally, the market gave a decent return of 10.03%, in the initial years market had to face a lot of financial scams, the economy was in stagflation, INR depreciation and the last 5 years market had to face many challenges starting from US-China trade wars, Demonetisation, GST, Brexit, Equity Taxation and finally the Covid pandemic. Hence the returns remained subdued throughout the decade.

2021-2031

- This decade can be once in a blue moon opportunity for India, China is facing an ageing population and hence recently announced 3 child policy, the working population of China will not expand for the next 20 years and hence manufacturing capacity expansion has to be installed in the country with surplus and cheap labour supply and India can be one of the beneficiaries. Additionally, post-pandemic many industries are adopting China + 1 policy to diversify their production.

- The government has managed to capture this well in advance with PLI (Production Linked Incentive) Scheme and lowered taxation to as low as 15% to be globally competitive.

- The manufacturing sector is a labour intensive sector, hence it will boost job creation, consumption and increase GDP and per capita income significantly. The make in India scheme is also on a similar front to reduce the import payment and decrease the trade deficit to restrict the INR depreciation against the Dollar to some extent.

- Considering this, although optimistic, I personally won’t rule out the possibility of Sensex reaching 2,00,000 by 2031. Since most of the reforms are already been made, the political stability and international diplomacy will play a vital role in India’s overall growth for this decade.

- On a conservative scale, if Sensex grows at 10% CAGR which seems very modest, it will be around 1,27,000 in 2031, at 12% it will be ~1,52,000 and at 15% it will be ~1,98,000.