Off late Cryptocurrencies especially Bitcoin and Dogecoin are the hot favourite talks of millennial investors who trade in equities regularly and are fond of instant gratification it provides. Equity market are on a one side rally for the past few months and many new traders in the market made some quick bucks since most of the shares in the market was going up and so was their portfolio. In fact, many have made it their parallel source of income.

Now that the markets are heated up, it seems to be saturated soon and alongside you see the cryptocurrencies surging unbelievably, there is a thought to invest in these currencies which has given returns better than a multi-bagger stocks.

When we buy stock, we value it based on its Assets, Earnings, Quality, growth potential we also try to comprehend the macroeconomic factors, business cycles and valuations; but that’s not the case with Bitcoin, people are buying on a presumption that more will buy in the future and the supply will be restricted. In fact, 80% of the Bitcoin supply for this century has already been done.

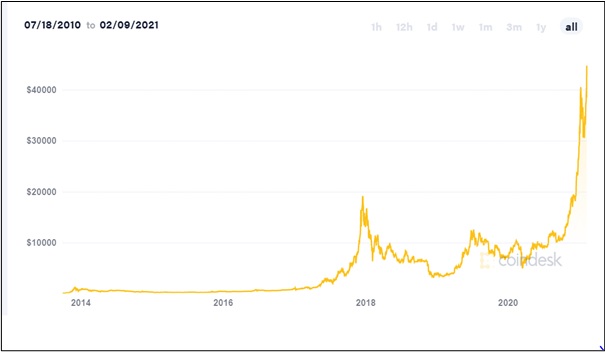

For the record, Bitcoin was under $500 in 2016, it went up till $17,000 (3400% Return) in 2018, came back to $3200 (a fall of 80%) in the same year and now its trading at $46,000 range after Tesla’s investment of $1.5 Billions which helped it surge more than 20% in a week.

So far, we understood that it does not have any fundamental backings and its price is a function of demand and supply force. There is a demand since people believe the supply is restricted but is it really? Over the years there are more than 8,200 types of cryptocurrencies, bitcoin due to first move advantage did manage to grab the dominant market share but due to new cryptos getting launched almost every day the supply seems to be practically unlimited which breaks their golden pillar on which they boast and justify its prices.

Any analogy which comes closer to this is like a game of passing the parcel, the one who possess it when the music stop, loses the game. The music is on now and people investing are making money until the music stops which will burst the bubble. Central bank of any powerhouse country may ban cryptos in future which will restrict the demand to break the rally and reverse the trend, there are talks that India may soon take an aggressive stance against the cryptocurrency. We do not know if and when that would happen, till that time it may increase multiple fold as it seems it getting accepted by new age companies and famous personalities like Tesla and Elon Musk.

If you are one of those who are influenced by it, just see what percentage of their net worth they have invested, even if it is $1.5 Billion USD and how much are you planning to. You’ll get the answer. The thumb rule says one should avoid those investments that they do not understand but practically for a risk enthusiast person I feel maximum 1% of the net worth/ 1 month savings can be deployed in experiments like these, strictly no SIPs or downward averaging if it falls. It can be one of the assets of the experiment bucket and not overall. The principle of diversification stays strong here too.

On a lighter note, one should refrain themselves predicting its future prices and plan to pay off their mortgages or plan for an early retirement. Such dream should always be dreamt when the money materialises ?.